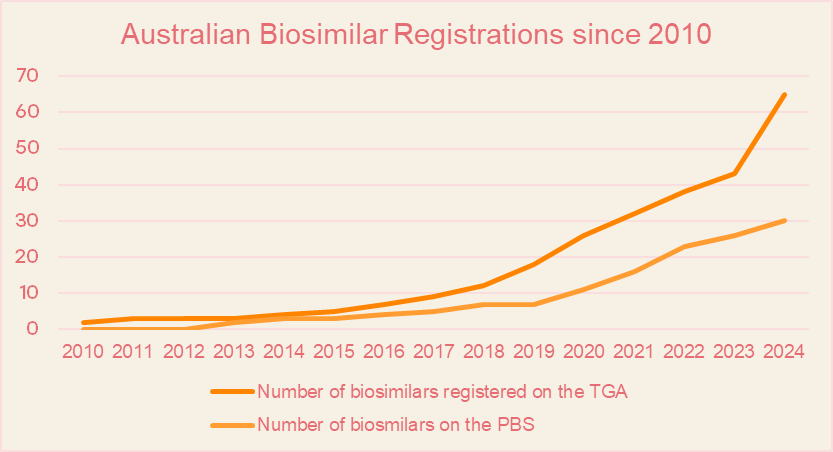

Over the past 15 years, Australia has steadily cultivated a strong biosimilar market, anchored by a reliable regulatory framework and an expanding list of PBS reimbursements. In 2024, it reached a major inflection point, recording a surge in TGA biosimilar registrations that more than tripled the previous year’s figures.

In this post, we take a look at Australia’s biosimilar ascent, the policy and legal dynamics shaping its future, and the persistent hurdles that are slowing its momentum.

A Market on the Rise

Australia’s biosimilar market is entering a transformative era, projected to grow from USD 741.6 million in 2024 to USD 5.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of 22.2%[1].

Over the past decade, the country has witnessed a dramatic rise in biosimilar registrations with the Therapeutic Goods Administration (TGA), a signal of its commitment to broadening access to cost-effective biologic therapies. From just 2 registered biosimilars in 2010, the number surged to a total of 65 in 2024, with a record 22 new approvals in 2024 alone[2]. Momentum continues in 2025, with 7 biosimilars already approved, including:

- Uteknix (ustekinumab biosimilar)

- Stoboclo and Osenvelt (denosumab biosimilars)

- Tyruko (natalizumab biosimilar)

- Eydenzel, Enzeevu, and Afqlir (aflibercept biosimilars)

This rapid growth has been driven by streamlined regulatory pathways, greater alignment with international standards, and proactive government initiatives aimed at encouraging biosimilar development and uptake. The Australian government has implemented several programs to encourage biosimilar use, including the Biosimilar Awareness Initiative and PBS uptake drivers. These efforts have led to a steady increase in the number of biosimilars listed on the Pharmaceutical Benefits Scheme (PBS), from just two in 2013 to 30 by the end of 2024[3].

Still Behind Global Leaders: Australia’s Biosimilar Uptake Challenge

Despite commendable strides in regulatory approvals and PBS listings, Australia’s biosimilar uptake continues to trail behind global frontrunners like the United States and Europe. While the TGA has approved over 65 biosimilars, actual market penetration remains modest, limiting the full impact of these therapies on healthcare costs and patient access.

According to IQVIA’s Impact of Biosimilar Competition in Europe (2024), biosimilars now account for 30–40% of biologic prescriptions across many EU countries, with some therapeutic areas and nations like Denmark exceeding 60% uptake[4]. Europe entered the biosimilar market in 2006, and its strong market growth has been attributed to early regulatory clarity, centralised EMA approvals, and strong substitution and tendering policies. The United States, though a later entrant in 2010, has also rapidly gained ground. The FDA’s interchangeability designation has enabled pharmacy-level substitution in many states, accelerating adoption. In certain drug classes such as filgrastim and bevacizumab biosimilars have captured 70–80% market share[5].

In contrast, Australia’s uptake of anti-TNF biosimilars in retail pharmacy settings is just 36%, well below the OECD average of 67%[6]. Several factors have been attributed to this lag including limited substitution policies, slower prescriber adoption, and fewer competitive dynamics[7]. And as a result, Australia has not yet realised the full potential of biosimilar-driven savings and access improvements seen in other regions.

Rising Patent Litigation Activity

As Australia works to close the gap in biosimilar uptake compared to global leaders, another dynamic is beginning to reshape the landscape: arise in patent litigation. Australia is experiencing a marked increase in biosimilar patent litigation as competition intensifies across high-value biologic markets.

In 2025, aflibercept has become a focal point, with Regeneron and Bayer initiating Federal Court action against Sandoz[8] alleging infringement of a key patent protecting Eylea® relating to methods of treatment for angiogenic eye disorders. More recently on the 5th of August 2025 Actor Pharmaceuticals filed proceedings against Regeneron and Bayer in the Federal Court, and while details are not yet public, it is likely also related to one of the Australian patents protecting Regeneron/Bayer’s Eylea® product[9]. Similarly, the recent approval of multiple denosumab biosimilars including Stoboclo® and Osenvelt® has raised the stakes in the osteoporosis and oncology segments, where originator manufacturers are pursuing legal avenues to defend their market share[10]. Meanwhile, evolocumab (marketed as Repatha®), a PCSK9 antibody used to treat hypercholesterolemia, is also drawing attention with five of Amgen’s patent applications surviving an appeal from the Australian Patent Office to the Federal Court earlier this year[11].

Take Aways

These cases underscore the growing commercial stakes and legal friction accompanying biosimilar expansion, with implications for market access, pricing, and long-term healthcare savings.

Stay tuned for further updates, we’ll be reporting more as these cases unfold and the market continues to evolve.

Are you interested in learning more about biosimilars and patents in Australia? Please feel free to reach out to MBIP to be put in contact with one of our skilled patent attorneys.

[1] Australia Biosimilar Market Size Report 2025-2033

[2] Biosimilar medicines approved by the Therapeutic Goods Administration | Australian Government Department of Health, Disability and Ageing

[3] biosimilar-medicines-subsidised-on-the-pharmaceutical-benefits-scheme.docx

[4] the-impact-of-biosimilar-competition-in-europe-2023.pdf

[5] Samsung Bioepis Q1 2025 Biosimilar Market Report (SB+Biosimilar+Market+Report+Q1+2025.pdf)

[6] Sandoz calls for half-price biosims 04.06.2025 AM

[7] Ibid

[8] Regeneron Pharmaceuticals, Inc. & Ors v Sandoz Pty Ltd (File details – applications for file

[9] Actor Pharmaceuticals Pty Ltd v Regeneron Pharmaceuticals, Inc & Anor (File details – applications for file

[10] Amgen v Sandoz NSD 590/2025

[11] Sanofi v Amgen Inc. (No 3) [2025] FCA 387